In a move that may make home and other loans cheaper, finance minister Nirmala Sitharaman announced that banks will soon launch loans benchmarked against the RBI’s repo rate.

While announcing stimulus measures to boost the economy, amidst concerns of a slowdown, finance minister Nirmala Sitharaman, on August 23, 2019, said that banks had agreed to launch loan products linked to the RBI’s repo rate. This is likely to ensure faster transmission of interest rate changes to home loan borrowers, among others. She added that banks will also pass on the RBI’s recent rate cuts to borrowers on the MCLR regime. Other measures announced, include additional liquidity infusion to the tune of Rs 20,000 crores by the National Housing Bank (NHB) to housing finance companies (HFCs), in a bid to ease the liquidity crisis in the sector. On the issue of stalled projects and other problems faced by home buyers, Sitharaman said that the government was holding consultations with various stakeholders and would announce measures in the near future.

Only 23 housing projects comprising 7,620 units were launched during April-June quarter under the subvention scheme, which has been banned recently by the National Housing Bank (NHB), according to property consultant Anarock.

Worried over frauds by builders, last month, the NHB asked housing finance companies (HFCs) to "desist" from offering loans under subvention scheme wherein real estate developers pay interest on behalf of home buyers for a certain period of time.

Generally, builders bear the interest till possession of flats so that homebuyers do not have to pay rent and their monthly installments together.

After the NHB directive, industry body CREDAI demanded a rollback of this decision as it would affect housing demand as well as liquidity of developers.

"The ban on subvention schemes will doubtlessly contribute to the sector's overall liquidity issues as players can no longer use them to attract customers. However, only a limited number of developers were affected by this move," Anarock Chairman Anuj Puri said in a report.

The NHB's directive was not as crippling as was initially assumed, the consulting firm said.

As per the research report, out of the total 280 projects launched in the April-June quarter of 2019, only about 23 projects (or 8 per cent) were marketed under subvention schemes.

These 23 projects comprised of 7,620 units – about 11 per cent of the total 69,000 units launched in the quarter.

"Our data also reveals that among the affected projects, those by larger players, strongly backed by financial lenders while offering such schemes, outnumbered projects by smaller developers," Puri said.

In city-wise analysis, Mumbai Metropolitan Region (MMR) has the maximum number of projects affected by the subvention scheme ban, with as many as 17 projects comprising 5,310 new units being launched under this plan.

Bengaluru came a distant second with just four new housing projects being marketed with subvention schemes.

Interestingly, both NCR and Pune had only one project each being sold under such schemes.

Kolkata, Chennai and Hyderabad had no new project launches offering subvention schemes.

"With subvention schemes off the table, developers will have to get creative with differentiated unique selling points to market their projects and boost sales. There seems to be no relief from the protracted pain the market has been experiencing in recent years," Anarock said.

Unsold housing inventory in Gurugram rose over 10 per cent during the last two years, in contrast to a decline in stocks in other parts of the National Capital Region (NCR), an Anarock report said on Thursday.

The report noted that the unsold inventory in Gurugram rose from 51,220 units in the second quarter of 2017 to 56,550 during the corresponding period of 2019.

"In the last two years, Gurgaon had the dubious distinction of adding 10 per cent to its unsold stock rather than seeing a decrease. In Q2, 2017, Gurgaon had nearly 51,220 unsold units (piled up further to stand at 56,550 units in Q2, 2019)," it said.

The report further said that in contrast to Gurugram, Noida had 27,000 unsold homes in Q2 of 2017 which decreased by 23 per cent to 20,860 units in Q2, 2019. Similarly, in Greater Noida, unsold inventories decreased by 26 per cent between Q2, 2017 and Q2, 2019, from 69,080 units to 50,810 units.

"Meanwhile, Ghaziabad saw its unsold stock decrease to 30,250 units in Q2, 2019 -- declining by 22 per cent in two years. Faridabad, having least unsold inventory in NCR (of 5,180 units) saw the stock fall by 27 per cent since Q2, 2017," it said.

However, Delhi saw its unsold stock pile up to 12,340 units during the April-June 2019, increasing by 4 per cent since the corresponding period of 2017.

Property prices in Gurugram are higher than those in Noida or Greater Noida. The report showed that the total value of the unsold units in Gurgaon (56,550 units) is nearly Rs 80,570 crore while in Greater Noida, the value of 50,800 unsold units is roughly Rs 26,720 crore. Noida's 20,860 unsold units are worth Rs 18,380 crore.

It indicates that the unsold properties in Gurugram largely belong to the luxury segment against affordable properties in Greater Noida, the report said.

Q: Is M3M Broadway Rera Registered?

Ans: Yes, the project is RERA registered. Rera No. is 31 of 2018. You can find details on Haryanarera.gov.in.

Q: What is Exact Location of M3M Broadway?

Ans: The Broadway is located next to Concourse, Sector 71, Golf Course Extension Road, Gurgaon.

Q: What is the construction status and possession date of M3M Broadway?

Ans: The status of M3M Broadway is under construction and will be available for possession in Dec, 2023.

Q: What is the starting price of shops in M3M Broadway?

Ans: The investment of shops in M3M Broadway starts at ₹50 lac.

Q: Payment Plan Available in M3M Broadway?

Ans: M3M Broadway offers 60:40 PLP payment plan, '60% within 30 days of booking and 40% on offer of possession'. You will get an 11% return on investment and a 2-year lease guarantee with the double rental benefit.>

Q: What is the size or area range of M3M Broadway?

Ans: The size range of M3M Broadway ranges between 300 to 3500 Sq.Ft

Q: What is the total land area of M3M Broadway?

Ans: The M3M Broadway total land Area is 7.85 Acres.

Q: How many numbers Of units are there in M3M Broadway?

Ans: The M3M Broadway has 600 Units.

Q: How many numbers Of towers are there in M3M Broadway?

Q: How many numbers Of towers are there in M3M Broadway?

Ans: The M3M Broadway has 2 Tower.

A) Broadway - which has Retail shape up to 3rd floor and virtual Office space up to 22.

B) SKY Loft: Which is a Service apartment. (19 ft high)

Q: What type of furnishing is there in M3M Broadway?

Ans: The M3M Broadway is Semi Furnished.

Q: Types of property are there In M3M Broadway?

Ans: The M3M Broadway has Retail Space-Mall, Multiplex, Office Space-Commercial/Mall, Food Court Space.

Q: key amenities of M3M Broadway?

Ans: The M3M Broadway amenities are 24X7 Power Back up, 24X7 Security, Air Conditioning, Bank/ATM, Covered Parking, Garden, Kids Play Area, Landscaped Park, Lift, Maintenance Staff, Open Parking, Rain Water Harvesting, Shopping Arcade, Visitor Parking, Water Storage, Wifi.

Want to buy your first home? Get These Things Check Beforehand

Are you a first-time home buyer? Then you must be in a state of confusion with regards to lots of things like Developers Background,Developers Background, Land Record,Flat’s Carpet Area,Location and Neighbourhood,Check Accessibility,Check Accessibility,Hidden and Additional Charges,Check Payment Plan,Associated Banks You have to check , and many other things. However, in order to avoid last-minute hassles or any future consequences, rechecking all the above things is quite important. So, here’s a checklist which first-time homebuyers must follow to avoid any kind of discomfort and insecurity:

Check Developers/Project Background

It’s easy today for a developer to enter into insolvency, but it’s not easy for a first-time homebuyer to put their hard-earn money into the stressed project. So, it’s better to check the background of the developer beforehand. To do this, one can easily check all the details of the developer of the RERA website. In order to enhance transparency in the Indian real estate sector, the government has made it mandatory for all the developers to enter their information on the RERA portals.

Land Record:

The land on which your Building/flat is built is very crucial. You must research about the soil quality and topography of the land on which the house is constructed. The plot should also be clear of all dues and be registered. Before buying a house, the title deed must be verified and checked in detail. The deed gives all details on the rights, ownership and obligations towards the property.

Flat’s Carpet Area:

Usually, a property’s area or the super built-up area that is listed is the entire area including shafts, elevator space, stairs, thickness of walls and others. However, carpet area is the actual area within the walls of the flat. This are can be 30 per cent lesser than the built-up area or the area used to calculate the price of the property. In some cases, when a floor is shared between two owners, the price of the common spaces are

Location and Neighbourhood

After checking all the major property related documents and background, it’s time to check the locality and neighbourhood of the project. Always pay a visit to the site location where the project is being developed. Check infrastructural developments like roads, electricity, and water supply, banks and ATMs, grocery stores, local markets, etc. Also, check the property prices in the neighbourhood areas like the cost of the same size and configuration housing unit. This will help you in understanding that if the developer is charging more from you on similar properties.

Check Accessibility

Whether you are single working professional or have a family, it’s important to check that the project's accessibility from major areas, hospitals, entertainment centers, office spaces and above all public transportation systems like buses, metro, railway, airport, etc. The project should not be located on a deserted place where even the basic amenities are quite far.

Hidden and Additional Charges:

Ensure that all the clauses of the documents are read in detail and penalty clauses be understood. The builder is required to pay you a monthly penalty in case you do not receive the flat’s possession within the grace period. Additional expenses such as GST, stamp duty, home loan processing fee, registration charges and all other charges should also be kept in mind.

Check Payment Plan

For a first-time home buyer, it is very important to carefully select a proper payment plan which does not cost them financially. Today, in order to woo customers, developer’s offers attractive payment plans like construction linked, down payment, flexi payment offers, and possession linked plan. But, avoid falling into these traps and research carefully before you opt in any plan.

Associated Banks

In case you are opting for a home loan, do check whether any bank is associated with the property or not. These days due to strict regulations and norms, many banks avoid giving loans to beleaguered developers. So, don’t fall into traps of such developers.

Buying a house is one of the biggest steps in your life, however you must remember each of these points before you seal the deal.

Dear Candidate !

Roles and Responsibilities

Desired Candidate Profile

Perks and Benefits : Conveyance / Incentive

Role : Sales/Business Development Manager

Industry Type : Real Estate, Property

Functional : Sales

Employment Type : Full Time Permanent

Education

UG :Any Graduate in Any Specialization

PG :Any Postgraduate in Any Specialization

Key Skills

Real EstateSales Executive Activities

Regards

Hr. Hiring & Recruiter

Mradula

CALL: 8373909126

Price : 70L To 1.6cr (ready to move)

This is the conversation that every resident will have with their friends after they own a home at M3M Sierra. The latest architectural brainchild of M3M, the Sierra is a beautiful vision brought to reality. The aim of this state-of-the-art township is to make home the favorite hangout destination so that families get a lot of time to spend with each other.

Life is busy and traffic is jammed on roads, and after a lot of struggle, one reaches home. And although going out to a restaurant sounds like a relief, the fact is that it will be painful and tiring as you will have to undergo the same struggle again. But if you are staying at m3m Sierra, you just have to be home and relish the serene view from your living room. How many restaurants or public spots can offer you the view of the lake; none in Gurgaon.

Sierra is surreal and made real. It allows you to experience a kind of living that is both exquisite and rejuvenating. The combination of refreshing ambiance and nature amalgamated with immaculate interiors will ease your mind and bring you peace. To further elevate your 'peace of mind', this property comprises all modern amenities like perimeter security cameras, guards, panic alarms, fire fighting systems and Earthquake Resistant Buildings.

The location of the property is another major benefit that makes it a great investment. M3M Sierra Sector 68 Sohna Road Gurgaon is a reputed residential locality and is just a fifteen minutes drive from Huda City Centre metro station. A residence here allows easy accessibility to almost all the major life amenities like hospitals, airports and railway stations.

The lavish accommodations come packed with ultramodern features that are available for ownership at a very economical cost. M3M is allowing booking in just 10% of inventory Cost! M3M is a brand that has consistently set industry benchmarks by delivering innovative, unique and unparalleled concepts. A trendsetter when it comes to high-value real estate advisory, M3M deserves the reputation of the foremost real estate brands in Delhi/ NCR. So go ahead, as you will be making a perfectly safe and sound investment. #BookyourapartmentatM3M Sierra.

What are the maintenance charges for this M3M Sierra 68?

Maintenance charges per month in this project are Rs. 1 charges/sqft.

How much EMI Do I need to pay?

For buying 2BHK projects, you would be paying around Rs. 60,045 to Rs. 90,141 for a period of 15 years loan tenure at 9.0% interest.

What are the builder credentials? Share his past project details?

They have undertaken 5 projects until now, out of which 3 projects are undergoing.

Where is M3M Sierra located?

The project is located in M3M Sierra Sohna Road, Sector-68, Gurgaon, Haryana, INDIA.

How much is the area of 2 BHK in M3M Sierra?

The area of 2 BHK apartments ranges from 1197 sq. ft to 1400 sq.ft.

What is the total size of M3M Sierra?

The project is spread over an area of 2.00 Acres.

What is the price of 2 BHK in M3M Sierra?

Gurgaon is a residential hub for Elite Class people in India Due to infrastructure, Corporates, and nearby international air stations. So that several renowned developers launching residential projects here. If you are looking forward to buying a Luxury home in Gurgaon in the price range 1.6 Cr to 3Cr you should check out DLF Ultima in Sector 81. You might be interested in the DLF Ultima Project, which is quite impressive Specifications. The Units are spacious and well planned comes in 3 BHK,3+S BHK, and 4 BHK. The apartments come with large balconies to allow the residents to enjoy ample fresh air and beautiful views.

The locational of DLF The Ultima Sector 81, Gurugram are quite alluring. Reputed schools and hospitals lie within a close radius. shopping malls, restaurants, cinema halls, etc are easily accessible.anyone can easily get across to the rest of the NCR in a quick time. Gurgaon being a major hub of business, the residents can enjoy lucrative commercial prospects. Interested buyers may check out the DLF Ultima master plan to get a better understanding of what’s on offer.

The Ultima is surreal and made real. It allows you to experience a kind of living that is both exquisite and rejuvenating. The combination of refreshing ambiance and nature amalgamated with immaculate interiors will ease your mind and bring you peace. To further elevate your ‘'peace of mind’', this property comprises all modern amenities like perimeter security cameras, guards, panic alarms, fire fighting systems and Earthquake Resistant Buildings.

The lavish accommodations come packed with ultramodern features that are available for ownership at a very economical cost. The Ultima is allowing booking in just 10% of inventory Cost! DLF is a brand that has consistently set industry benchmarks by delivering innovative, unique and unparalleled concepts. A trendsetter when it comes to high-value real estate advisory, DLF deserves the reputation of the foremost real estate brands in India. So go ahead, as you will be making a perfectly safe and sound investment. Book your apartment at The Ultima!

What is an available flat size in DLF The Ultima?

Flat sizes in the project range from 1911.0 sq.ft to 2872.0 sq.ft. All flat size available

What is the area of DLF The Ultima?

The total area that the project occupies is 22.0 Acres.

What is the area of 3 bhk in DLF The Ultima?

Three-room units (3BHK) in the project are available in an area of 1911.0 sq.ft to 2132.0 sq.ft.

How many units are available in DLF The Ultima?

The project has a total of 500 units.

Does DLF The Ultima have a swimming pool?

The project has a swimming pool.

What is the size of 4 bhk in DLF The Ultima?

The area of 4 BHK apartments ranges from 2500.0 sqft to 2872.0 sqft.

How much is the price of 4bhk in DLF The Ultima?

4 BHK units in the project are approx priced at Rs. 16750000 to Rs. 22674440. do you want best price ? call +919811471907

Which banks are providing loan facilities for DLF The Ultima?

HDFC Home Loans, ICICI Bank and 2 more provide loans for this project.

What is the average price in DLF The Ultima?

Prices of flats in the project start from Rs. 12803700 and go up to Rs. 22674440.

#best realestate agent gurgaon

#investment property in Gurgaon

Whether you wish to buy an Individual Home in Gurgaon or a Luxury flat, you first need to identify best locations to buy property in Gurgaon/Delhi NCR. Especially when you are looking for luxury properties, you need to list out your budget and locations where prices of properties aren’t raised very high, so we list out (categorize) property based on price range.

Price : 19.7 Cr Onwards*

Price : 16 Cr Onwards*

Price : 11.00 Cr Onwards*

Price : 17.00 Cr Onwards*

Price : 14 Cr Onwards*

Price : 10 Cr Onwards*

Price : 10.22 Cr Onwards*

Villas|Penthouses, Price :9 Cr* Onwards

Price :5.73 Cr Onwards*

Price : 6.5 Cr Onwards*

6.50 Cr Onwards*

5.35 Cr Onwards*

5.45 Cr Onwards*

Price : 5.18 Cr Onwards*

5.14 Cr Onwards*

Price : 5.90 Cr* Onwards

5 Cr Onwards*

5.50 Cr Onwards*

₹ 2.46 Cr Onwards

₹ 2.60 Cr Onwards

₹ 2.30 Cr to 3.00 Cr Onwards

₹ 2.19 Cr Onwards

1.85 Cr Onwards*

₹ 2.70 Cr to 2.94 Cr

₹ 2.77 Cr Onwards

₹ 2.10 Cr Onwards

₹ 2.14 Cr Onwards

₹ 2.83 Cr Onwards

₹ 2.23 Onwards

₹ 2.48 Cr Onwards

2.20 Cr Onwards*

3.65 Cr Onwards*

3.25 Cr Onwards*

3.50 Cr Onwards*

Price : 4.7 Cr Onwards*

Alpha Gurgaon One

ATS Kocoon

Emaar MGF Gurgaon Greens

Sidhartha Luxuria Residency

Emaar MGF Palm Gardens

Raheja Atharva

Uppal G99

Raheja Vedaanta Floors

Conscient Heritage 2

IndiaBulls Enigma

Puri Diplomatic Greens

Raheja Vedas

Sobha International City

BPTP Amstoria

Adani Oyster Grande-Sector 102, Gurgaon

GODREJ FRONTIER, SECTOR 80, Gurgaon

Godrej Oasis

Godrej Aria

Godrej Natura

Antriksh Heights

Ramprastha Rise

Mahindra Aura

Godrej 101

Godrej Habitat

CHD Golf Greens Avenue

Godrej Nature plus

Godrej air

Antriksh Zeal

Raheja Shilas

Coralwood – SS Group

Ramprastha Edge Towers

Ramprastha Skyz

IndiaBulls Centrum Park

DLF Townhouses

Earth Copia

Chintels Paradiso

Satya Hermitage

Assotech Blith

Ansal Estella

Ansal Heights 86

Era Cosmo City

Sidhartha Estella

BPTP Fortune Towers

Cosmos Express 99

BPTP Park Generations

Spiritwood Flexi Homes

BPTP Spacio Park

Ramprastha The Atrium

Spaze Privy AT-4

Tashee Capital Gateway

Imperia Esfera

Ninex Corona

Click Here For Sector wise price 👇👇👇

https://www.99acres.com/property-rates-and-price-trends-in-societies-in-gurgaon

Click Here For Sector wise price 👇👇👇

https://www.99acres.com/property-rates-and-price-trends-in-gurgaon

Click Here👇👇👇

https://ayuni.in/Property/Propertyin?City=Gurugram&CId=2&PropertyType=Residential&PropertyTypeId=2

Top 10 / 15 Residential property in Gurgaon 2020

Click Here👇👇👇

https://ayuni.in/Property/Propertyin?City=Gurugram&CId=2&PropertyType=Residential&PropertyTypeId=1

After lots of searching, comparing and negotiating you came to a conclusion and finalized your deal. The first step after the deal is to find an answer to the question - what documents are required to buy property in India ?.

Probably most of the buyers don’t get the right documents. Even more not having complete documents property owners or buyers leads to a struggle at the time of selling property. In fact, most of the buyers and Property owners are not aware of each documentation. It plays an important role in the purchasing process, as original or not and sometimes the requirement of documents varies from case to case in each state

There is a list that might be considered as a checklist of documents required to buy a property.

This is the main legal document required which admits the ownership of any property. Below all it refers to the transfer of ownership in favour of Property buyer from Property seller/Owner . For the reason that it’s called legal proof for ownership of property.

Khata is an account registration as a record in the local municipal office to confirm construction of property , finally as approved plan.

There is two kind of Khata as below

Certificate– It is a mandatory document for registration of new property after paying all taxes. Therefore Khata certificate will need to be present as the name mentioned as owner of the property only. Hence not for any member of the family.

Extracts– This is another document, refers as detail of property as registered format contains name, size, purpose of property (residential/commercial), assessment land.

These documents buyers need to have , with a set of date when possession would have been handed over from the developer. Therefore the original copy of this document needs to be in front of the bank while applying for a loan.

The owner has legal bound to pay tax on property. Similarly that’s why owners make sure that none of the tax pending should be with concerned property before purchasing it . Also tax receipts are also considered as legal ownership of property.

The documents required if anyone is buying new property so ask for the original receipt and if the property on resale asks for a copy of the receipt.

Certainly local authorities ask developers to make sure that property is finally ready to handover as a result of the sanctioned plan.

This document shows that there is no pending mortgage or legal due with property . It is one of the key documents which is mandatory for loan approval for the property also . Form 15 needs to have when property is in encumbrance and even that Form 16 needs to have when no encumbrance with property.

Finally , this document admits construction of the project is according to approved plan and needs to come in front of the bank when applying for home loan.

Other Documents Required To :

Building plan sanctioned by statutory authority

Most noteworthy , NOC from electricity /pollution department board

Note : if You have any Quiry regarding Docomentation call- +919811471907 Free assistance.

#Best Property dealer in gurgaon

#Real estate agent Gurgaon

#realestate investment

#Residencial Property in Gurgaon

#ayuni direct realty

The total length of the corridor shall be about 28.80 km, consisting of 27 elevated stations with six interchange stations involving a cost of Rs 6,821.13 crore, an official statement read more ........

CHANDIGARH: To provide metro rail connectivity to the residents of old Gurugram, the Haryana government on Thursday accorded approval for a final detailed project report (DPR) of metro rail connection from HUDA City Centre to various important locations in the industrial city.

The total length of the corridor shall be about 28.80 km, consisting of 27 elevated stations with six interchange stations involving a cost of Rs 6,821.13 crore, an official statement said after a cabinet meeting was chaired by Chief Minister Manohar Lal Khattar in Chandigarh.

"This link would start at HUDA City Centre (Gurugram) and move towards Sector 45, Cyber Park, District Shopping Centre, Sector 47, Subhash Chowk, Sector 48, Sector 72A, Hero Honda Chowk, Udyog Vihar Phase 6, Sector 10, Sector 37, Basai village, Sector 9, Sector 7, Sector 4, Sector 5, Ashok Vihar, Sector 3, Bajghera Road, Palam Vihar Extension....and finally merge in existing metro network of Rapid Metrorail Gurugram, at Moulsar Avenue station near Cyber City," the statement said.

This Mass Rapid Transit System (MRTS) project will connect maximum parts of Gurugram city. It will interchange with MRTS corridor at Subhash Chowk, with a bus stand at Sector 10, with a railway station at Sector 5 and with the Rapid Metro at Moulsar Avenue station.

The MRTS corridor at Subhash Chowk will interchange with the yellow line at HUDA City Centre and provide direct connectivity to a large part of Gurugram with Delhi.

It will also interchange with Regional Rapid Transit System stations at Hero Honda Chowk and Sector 22 and provide connectivity up to Sarai Kale Khan, New Delhi on one side and on Shahjahanpur, Neemrana and Behror (SNB), Rajasthan on the other side.

These linkages will enhance the efficiency of the transportation system in the National Capital Region (NCR), it said.

In another cabinet decision, the state government has decided to give honorarium to the retirees of the government aided schools, who retired between July, 28, 1988 to May 10, 1998 through the scheme to be called Pt. Deen Dayal Upadhyaya honorarium scheme.

As per the decision, a retired principal will get an honorarium of Rs 20,000 per month, headmaster will get Rs 18,000 per month, and lecturer will get an honorarium of Rs 16,000 per month while masters including of Hindi, Punjabi, Sanskrit and Urdu will get Rs 14,000 per month.

Junior basic teachers, drawing teachers/physical training instructors, cutting and tailoring teachers will get an honorarium of Rs. 12,000 per month.

According to the zero period policy, announced last December, builders will be exempted from paying penal interest on outstanding land dues for the number of years their projects were stuck.

NOIDA: The Noida Authority on Tuesday extended the deadline for over a dozen builders to complete the pending projects here by December 31, 2021 under its 'zero period' policy, an official statement said. These builders had earlier assured delivery of homes by the end of June 2021.

The decision was approved during the 199th Board Meeting of the Noida Authority in the wake of COVID-19 situation.

According to the zero period policy, announced last December, builders will be exempted from paying penal interest on outstanding land dues for the number of years their projects were stuck.

However, the policy was applicable to those builders who were expected to provide homes by June 2021. The state government had expected one lakh new housing units to be constructed by that time.

"...the developers who have given written assurance to complete their pending projects by December 31, 2021, have been given an extension till December 31, 2021 from June 30, 2021 as part of the zero period policy. 16 (land) allottees have been issued letters for giving written assurance regarding completing the incomplete projects by December 31, 2021," an official press note stated.

The board also approved the annual budget of the authority, which has set a target of Rs 5,037 crore in revenue and Rs 4,640 crore budgted for expenditure for the current fiscal 2020-21.

The expenditures include expenses on land acquisition, development works, repair and maintenance of health and urban infrastructure, village development, miscellaneous expenses, among others, the statement said.

In the budget, the funds have been enhanced from Rs 600 crore to Rs 1,000 crore for land acquisition, and from Rs 106 crore to Rs 125 crore for village development, it added.

The board meeting was chaired by Alok Tandon, commissioner of infrastructure and industrial development, and chairman of three different authorities of Gautam Buddh Nagar.

Noida Authority CEO Ritu Maheshwari, Greater Noida Authority CEO Narendra Bhooshon and Yamuna Expressway Authority CEO Arun Vir Singh, among others, attended the meeting.

Altogether 37 agendas were put forth during the meeting besides 15 proposals for board's approval, it said. The 198th board meeting was held in April.

NEW DELHI : Google has signed a lease deal with flexible office space operator Simpli Work for a 4,50,000 sq ft area in Gurgaon to expand its operations, people in the know said.

“The office will have a lockin period of three-four years, opposed to over five-seven years in a conventional office building,” they said, requesting not to be named. The facility, which can seat at least 4,000 people, will become operational in 2020, they said.

US-headquartered Google is looking for more office space to be able to tap into the local market and engineering talent. It is close to signing a deal for a 1.2 million sq ft office space in Bagmane RIO in Bengaluru through a longterm lease.

Earlier this year, the firm had taken up 5,00,000 sq ft of space in Bagmane Capital. The company is also looking to expand in Hyderabad, where it occupies 4,00,000 sq ft in Knowledge Capital.

Simpli Work refused to comment. An email query sent to Google seeking confir-mation went unanswered.

“Many large companies are looking at flexible management spaces for the short term to expand, as these firms do not have to spend on capex. It is beneficial in terms of risk and timeline,” said one of the persons cited earlier. This move is expected to push up demand for flexible office spaces by six times to 35% of all office space requirement globally in the next three years, up from just about 5% now.

Currently, Google has four offices in India, including its country headquarters in Hyderabad and the recently-acquired 1,00,000 sq ft office space in the First International Financial Centre.

India is an attractive destinations for MNCs looking for high-value work and talent pool. Firms are looking at 50% conventional space on an over 10-year lease. Separately, 30% space will be on flexible model and 20% in a co-working environment, as per Knight Frank.

Separately, Wells Fargo is in discussion for a built-tosuit office space in Hyderabad with DivyaSree developers.

BENGALURU: India’s pandemic-battered commercial property leasing market is being propped up by deals in and around Bengaluru and Hyderabad, even as other big cities such as Mumbai and NCR see transactions limping back to normalcy.

Apple is negotiating with builders for a 350,000 sq ft office space in Bengaluru which will serve its global markets, and plans to open a large retail centre in the city, people in the know told ET.

There’s another big deal in the works — US-based financial services firm Wells Fargo is in talks for 1.4 million sq ft of office space in Hyderabad to expand operations. “Both the deals are expected to be signed in the next few days and in both cases the companies are expanding their footprint in India,” the people cited earlier said. “These facilities will be up by 2021.”

Apple’s new Bengaluru office is expected to come up at Prestige Mink Square. The company is also looking to step up manufacturing in the country.

Last month, Foxconn started assembling Apple’s top-end iPhones at its Chennai plant.

Separately, Wells Fargo is in discussion for a built-tosuit office space in Hyderabad with DivyaSree developers.

“Wells Fargo already occupies around 1.2 million sq ft in Hyderabad and is looking to further expand business,” said another person aware of the deal. An email query sent to Apple remained unanswered till as of press time.

The communications head of Wells Fargo, too, did not respond to ET’s messages and phone calls. Recently, MNCs including Google, Walmart, Amazon and Microsoft have either taken or are in the process of leasing large office spaces across Bengaluru, Hyderabad and Chennai for future growth.

In the first half of 2020, the southern property markets accounted for about 48% of the total office leasing in India compared with 51% in the same period a year ago.

As per Knight Frank’s latest report, Bengaluru contributed around 4.8 million sq ft of office space leasing in the country, while Hyderabad was at 2.2 million sq ft.

Rajender Sharda, who heads the GK-I M-Block market traders’ association, said that those who have already paid conversion charges should get a refund or the amount should be adjusted in floor area ratio.

NEW DELHI: In a major decision that would benefit large number of shops in local shopping centres (LSC) in areas such as Greater Kailash, Defence Colony, South Extension etc, the Delhi Development Authority (DDA) in its meeting on Thursday provided exemption from conversion charges to shops that were originally auctioned as purely commercial properties.

“DDA wanted to bring an amendment earlier in which shops using upper floors for commercial use had to pay conversion charges. However, when the proposal was put in the public domain, many people objected to it, saying the plots on which these shops are built were already commercial and upper floors were only used for residential purposes temporarily,” a senior DDA official said. “These plots were originally sold as commercial plots at a premium and the lease deed mentions that. Such shops wouldn’t have to pay conversion charges,” he said.

“There is, however, another category of shops, such as those in Sarojini Nagar and Khan Market, where upper floor was originally approved as residential. These shops will have to pay conversion charges,” he said.

“Shops in LSCs in Defence Colony and South Extension were sold as commercial plots at premium rates, and residential activity was allowed for a limited duration. Those who had paid premium commercial rates shouldn’t be made to pay conversion charge,” said Rajinder Malik, president of Defence Colony market association.

Rajender Sharda, who heads the GK-I M-Block market traders’ association, said that those who have already paid conversion charges should get a refund or the amount should be adjusted in floor area ratio.

Another important decision taken in the meeting, which was chaired by Delhi LG Anil Baijal, was the exemption from some statutory clearances for household industries. Household industrial units with maximum nine workers and 11 KW power operating in residential areas and new industrial units of the similar type would not need to take mandatory statutory clearances from labour and Industries departments and Delhi Pollution Control Committee (DPCC), with the condition that no polluting industrial units will be permitted as household industry.

The officers have been asked to complete the survey of the 242 shortlisted villages of populated areas by October 2, this year.

Haryana government has directed the officers to conduct a drone-survey of populated areas and the revenue estates so that people can get an online record of the ownership rights of their property.

The officers have been asked to complete the survey of the 242 shortlisted villages of populated areas by October 2, this year.

On the occassio of Gandhi Jayanti, Prime Minister Narendra Modi would be declaring one village in every district of the country as Lal Dora-free and will distribute deeds as well. However, Haryana aims to ensure that 11 villages from each district, which means in all 242 villages, are Lal Dora-free by October 2.

Deputy chief minister Dushyant Chautala, who also holds the portfolio of department of revenue and disaster management, confirmed this while presiding over the review meeting of the officers related to 'Haryana Large Scale Mapping and Ownership Project' (HaLSMP) at Chandigarh on Tuesday.

On the progress of drone survey, the deputy CM was apprised that in addition to the said 242 villages, drone survey has been completed in eight other villages and the remaining works are being done at a fast pace. In addition, data-processing has also been completed in 214 villages.

It was also informed that maps of 123 villages have been handed over to the district administration. On being informed that due to rough weather some drones started malfunctioning, the deputy CM instructed the officers concerned that the additional drones be sought and the work should be completed at the earliest.

Dushyant instructed the officers of the Survey of India (SOI) that along with the populated areas, revenue estates should also be surveyed so that ownership rights of every inch of land are verified. This will benefit the people of the state as they will be able to access digital records of their land at any time and will also save time and resources. He said that as per the agreement signed between the Survey of India (SOI) with the Haryana government, drone survey will secure the limits of villages, city and revenue estates, while ensuring there is no encroachment of any kind. He said that this will bring about transparency in the system.

Founded in 1946 by Chaudhary Raghvendra Singh, DLF started with the creation of 22 urban colonies in Delhi. In 1985, the company expanded into the then-unknown region of Gurugram, creating exceptional living and working spaces for the new Indian global professionals. Today, DLF is the largest publicly listed real estate company in India, with residential, commercial, and retail properties in 15 states and 24 cities.

Our diverse verticals reflect our dedication to developing ecosystems for India’s changing needs. But our foundation has always been our employees, our customers, our stakeholders, and our shareholders. We invest in spearheading innovation through empowerment and optimism, in order to build the foundation of India’s future on the legacy of our past.

Posted on August 31, 2020 by aakash in Buyers Guide, Gurgaon Property Insights, Investment, Location, Market Updates, News, Real Estate, Sales

Investing in something is a big deal. The investor needs to have a thorough knowledge on the sectors in which he is ready to invest. The choice to put resources in real estate or stocks is an individual decision that relies upon your investing limit, objectives, and investment risks. Real estate and the stock Market have different opportunities and risks. Real Estate requires examination, cash and time. In any case, it gives an easy revenue stream and the potential for significant appreciation. Stocks are liable to advertise, financial, and inflationary dangers, however don’t need a major money infusion, and they by and large can be effectively purchased and sold.

In case you’re planning to invest in Real Estate Gurgaon, you will need to spare and put down a considerable measure of cash. While investing in real estate you gain physical land or property. Real Estate Investors bring in cash by gathering rents (which can give a consistent pay stream) and through gratefulness, as the property’s estimation goes up. Additionally, since Real Estate can be utilized, it’s conceivable to grow your property regardless of whether you can’t stand to pay money altogether.

Real Estate Gurgaon is engaging on the grounds that it is a substantial resource that can be controlled, with the additional advantage of expansion for some real estate investors. Investors who purchase property own something concrete for which they can be responsible. Purchasing property requires more beginning capital than putting resources into stocks, common assets, or even land venture trusts.

Nonetheless, when buying property, speculators have more influence over their cash, empowering them to purchase a more important venture vehicle. Real Estate Gurgaon that produces month to month rental pay can increment with expansion even in a lease controlled territory, which offers an extra favorable position. Another thought is charges arising due to selling the venture.

Coronavirus that started in Wuhan, China has infected more than 400,000 people across the globe and claimed more than 20,000 lives so far. The World Health Organization (WHO) was quick to declare it a global pandemic and instructed countries to take effective measures to tackle the situation, social distancing being the most important one.

While COVID-19 has collapsed even the healthcare systems of the most powerful countries, it has equally affected the global economy. In India, PM Modi has declared a 21-day lockdown that is going to severely impact many businesses. In the midst of this virus outbreak, the Indian Real Estate Industry also cannot be spared from the downfall. So, let us see how Coronavirus affects the Indian Property Market.

Construction Material Imports from China will be Affected

India has been a heavy importer of construction material and electronic equipment from China. Though we are the second largest producer of steel, our production capacity is still not enough to fuel the high demand across the country. This is why we were dependent on the Chinese Imports for our steel and other construction needs. And now, with the COVID-19 situation, these imports will be largely impacted. The prices of construction material like steel, heavy equipment, fibre elements, electronic equipment, etc. is going to shoot up which will directly affect the profits of the developers.

Festive Season will not be the Same, This Year

Navratri, Gudi Padwa and Akshay Tritiya are almost here. NDuring this period, a number of real estate consultancies and even the developers would have started rolling out their festive season offers. Although a lot of offers can still be availed, the overall demand is low because investors are losing confidence in the market amid the COVID-19 outbreak. Most of the homebuyers and investors are from the salaried class. They are not sure about the future of their jobs and hence the demand is skewed.

New Project Launches will See a Fall

Since the developers are not sure about the liquidity of their current projects, they are likely to hold back on the new launches. The market would see a fall of 15 to 20 percent in the number of new launch projects. Developers who have already made a soft-launch of their projects are already incurring loss as they have spent a substantial amount on the marketing front.

Impact of Coronavirus on Commercial Real Estate

Commercial real estate that comprises office spaces, retail spaces and the hospitality sector will also be largely impacted. It can mainly be attributed to the skewed imports from China. However, with the prices going down, there would be a segment of investors who are likely to put their money in it and take the risk for a higher profit down the line.

Bottom Line

In case of any virus outbreak, every industry takes initial hit but previous records show that the market has recovered in a better way and the same can be expected with Coronavirus as well. We suggest the buyers and investors not to panic and hope for the best. The situation will surely improve with time.

PUBG Mobile banned in India

The Ministry of Information and Technology bans more Chinese apps including popular PUBG Mobile in the country on Wednesday. This time the government has banned 118 China-based apps.

Apps and after: China’s growing naval muscle will have to be jointly countered

In another strike on Chinese apps, government has banned 118 fresh entities for engaging in activities prejudicial to the sovereignty and integrity of India. In the latest round, the biggest casualty appears to be PUBG, the world’s most lucrative mobile game whose largest subscriber base is in India. At a time when India and China continue to face off at the border in eastern Ladakh, the curb on Chinese apps is both a security imperative preventing data leakages, and a strong message to Beijing that it can’t be business as usual.

New Delhi’s moves could, however, trigger a response from Beijing, not necessarily confined to aggressive moves along the LAC. China has all-round capabilities, and is adept at using an all of national power approach to bully neighbours. It could launch cyberattacks, for which New Delhi should be prepared. Its navy has rapidly expanded to become the largest in the world – with 350 warships to the US’s 293. As per a Pentagon report, China is actively trying to set up military logistics facilities in countries from Myanmar and Thailand to Pakistan, Sri Lanka and UAE. India could soon find itself surrounded by the Chinese navy.

Countering China at sea is therefore the big challenge next to resisting Beijing’s designs at the LAC. In this regard, India must immediately ask for regular naval exercises with the Quad grouping and other nations – including the UK, France, Vietnam etc – to balance China. Additionally, it must strengthen its force projection capabilities in the Andaman and Nicobar Islands, from where it can exploit China’s ‘Malacca Dilemma’ and retain the option to choke Beijing’s energy supplies in case of war. The high seas are the new grounds of powerplay. India and likeminded nations must coordinate to check China here.

The IT Ministry stated in an official press release that the Chinese apps have been “banned under the section 69A of the Information Technology Act read with the relevant provisions of the Information Technology Rules 2009 and in view of the emergent nature of threats has decided to block 118 mobile apps since in view of the information available they are engaged in activities which is prejudicial to sovereignty and integrity of India, defence of India, security of the state and public order.”

Here’s the list of all 118 Chinese apps that have been banned in the country.

1. APUS Launcher Pro- Theme, Live Wallpapers, Smart

2. APUS Launcher -Theme, Call Show, Wallpaper, HideApps

3. APUS Security -Antivirus, Phone security, Cleaner

4. APUS Turbo Cleaner 2020- Junk Cleaner, Anti-Virus

5. APUS Flashlight-Free & Bright

6. Cut Cut – Cut Out & Photo Background Editor

7. Baidu

8. Baidu Express Edition

9. FaceU – Inspire your Beauty

10. ShareSave by Xiaomi: Latest gadgets, amazing deals

11. CamCard – Business Card Reader

12. CamCard Business

13. CamCard for Salesforce

14. CamOCR

15. InNote

16. VooV Meeting – Tencent Video Conferencing

17. Super Clean – Master of Cleaner, Phone Booster

18. WeChat reading

19. Government WeChat

20. Small Q brush

21. Tencent Weiyun

22. Pitu

23. WeChat Work

24. Cyber Hunter

25. Cyber Hunter Lite

26. Knives Out-No rules, just fight!

27. Super Mecha Champions

28. LifeAfter

29. Dawn of Isles

30. Ludo World-Ludo Superstar

31. Chess Rush

32. PUBG MOBILE Nordic Map: Livik

33. PUBG MOBILE LITE

34. Rise of Kingdoms: Lost Crusade

35. Art of Conquest: Dark Horizon

36. Dank Tanks

37. Warpath

38. Game of Sultans

39. Gallery Vault – Hide Pictures And Videos

40. Smart AppLock (App Protect)

41. Message Lock (SMS Lock)-Gallery Vault Developer Team

42. Hide App-Hide Application Icon

43. AppLock

44. AppLock Lite

45. Dual Space – Multiple Accounts & App Cloner

46. ZAKZAK Pro – Live chat & video chat online

47. ZAKZAK LIVE: live-streaming & video chat app

48. Music – Mp3 Player

49. Music Player – Audio Player & 10 Bands Equalizer

50. HD Camera Selfie Beauty Camera

51. Cleaner – Phone Booster

52. Web Browser & Fast Explorer

53. Video Player All Format for Android

54. Photo Gallery HD & Editor

55. Photo Gallery & Album

56. Music Player – Bass Booster – Free Download

57. HD Camera – Beauty Cam with Filters & Panorama

58. HD Camera Pro & Selfie Camera

59. Music Player – MP3 Player & 10 Bands Equalizer

60. Gallery HD

61. Web Browser – Fast, Privacy & Light Web Explorer

62. Web Browser – Secure Explorer

63. Music player – Audio Player

64. Video Player – All Format HD Video Player

65. Lamour Love All Over The World

66. Amour- video chat & call all over the world.

67. MV Master – Make Your Status Video & Community

68. MV Master – Best Video Maker & Photo Video Editor

69. APUS Message Center-Intelligent management

70. LivU Meet new people & Video chat with strangers

71. Carrom Friends : Carrom Board & Pool Game-

72. Ludo All Star- Play Online Ludo Game & Board Games

73. Bike Racing : Moto Traffic Rider Bike Racing Games

74. Rangers Of Oblivion : Online Action MMO RPG Game

75. Z Camera – Photo Editor, Beauty Selfie, Collage

76. GO SMS Pro – Messenger, Free Themes, Emoji

77. U-Dictionary: Oxford Dictionary Free Now Translate

78. Ulike – Define your selfie in trendy style

79. Tantan – Date For Real

80. MICO Chat: New Friends Banaen aur Live Chat karen

81. Kitty Live – Live Streaming & Video Live Chat

82. Malay Social Dating App to Date & Meet Singles

83. Alipay

84. AlipayHK

85. Mobile Taobao

86. Youku

87. Road of Kings- Endless Glory

88. Sina News

89. Netease News

90. Penguin FM

91. Murderous Pursuits

92. Tencent Watchlist (Tencent Technology

93. Learn Chinese AI-Super Chinese

94. HUYA LIVE – Game Live Stream

95. Little Q Album

96. Fighting Landlords – Free and happy Fighting Landlords

97. Hi Meitu

98. Mobile Legends: Pocket

99. VPN for TikTok

100. VPN for TikTok

101. Penguin E-sports Live assistant

102. Buy Cars-offer everything you need, special offers and low prices

103. iPick

104. Beauty Camera Plus – Sweet Camera & Face Selfie

105. Parallel Space Lite – Dual App

106. “Chief Almighty: First Thunder BC

107. MARVEL Super War NetEase Games

108. AFK Arena

109. Creative Destruction NetEase Games

110. Crusaders of Light NetEase Games

111. Mafia City Yotta Games

112. Onmyoji NetEase Games

113. Ride Out Heroes NetEase Games

114. Yimeng Jianghu-Chu Liuxiang has been fully upgraded

115. Legend: Rising Empire NetEase Games

116. Arena of Valor: 5v5 Arena Games

117. Soul Hunters

118. Rules of Survival

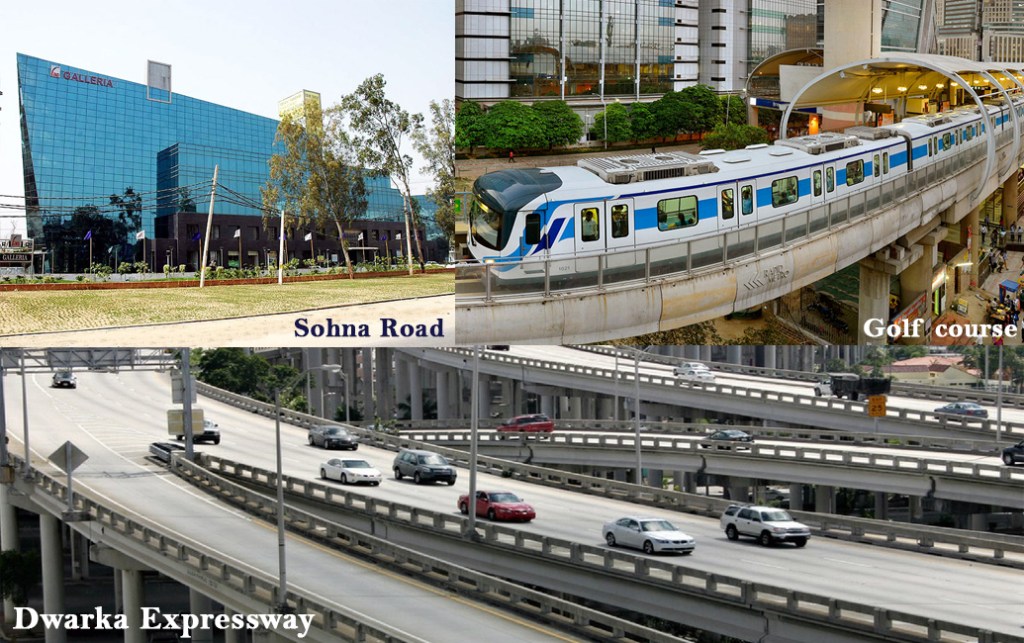

Gurgaon is a city of millennials and millennials are the driving factors for investors to invest in any property. The city of Gurgaon offers a wide variety of property in Gurgaon with lot of scope for getting returns and this is also an added reason why investors seek for this city. The city is huge and is full of opportunities. Investors must have thorough knowledge of the localities so that they could fetch the best returns from the investments they have made. Here are some localities of Gurgaon that are considered to be the best to make an investment in Gurgaon Real Estate.

Sohna Road is located in the South of Gurgaon and is the fastest progressing locality. The number of inhabitants in the area has been quickly developing lately, from its vicinity to different organization workplaces close to Sohna Road. Occupants could reach out for the necessary accesses, such as hospitals and schools. Sohna Road has developed as an exceptionally advantageous neighborhood offering the simple everyday environments and openings for work opportunities. Many Shopping malls are available within the locality. The people living in this locality makes Sohna Road a perfect place to live. Properties in Sohna Road are made accordingly to the inhibits. Commercial property in Gurgaon too have great opportunity to bloom in the area of Sohna Road

One of the most looked for after residing purposes in Delhi-Gurgaon is Dwarka Expressway. Dwarka Expressway covers territories like New Palam Vihar, Bijwasan and Kherki Daula. The development of underpasses and flyovers alongside new lodging ventures have been approved by the government. Dwarka Expressway, otherwise called Northern Peripheral Expressway, is a notable and favored area because of its nearness with Delhi. Because of the improved network and accessibility of good foundation, the region around the expressway is offering a steady advancement in Real Estate Gurgaon.

Golf Course Extension Road is full of life anytime of the day. The chirpiness of this locality makes Golf Course Extension Road a perfect place to set up Real Estate projects. This locality has nearness to the worldwide air terminal, metro network and private undertakings are on the whole making this region a speculator’s fantasy area to possess a house here. Encircled by top notch educational institutes, cafés, bistros, shopping malls, markets and health canters this region is the first choice to make profitable investments by the investors.

SBI Offers Up to Two years Repayment Relief for Home & Retail Loans

The moratorium period can be extended by a maximum of 2 years, India’s largest lender said Monday, setting the tone for other banks, specially PSU players.

State Bank of India will provide relief to home and retail loan borrowers impacted by Covid-19 in the form of either a moratorium of up to 24 months or by rescheduling instalments and extending the tenure by a period equivalent to the moratorium granted.

The moratorium period can be extended by a maximum of 2 years, India’s largest lender said Monday, setting the tone for other banks, specially PSU players.

In line with RBI’s one-time relief, the scheme is available to borrowers who had availed of a home loan before March 1, 2020 and were regular in repayments until the Covid-19 lockdown.

But the borrowers will have to demonstrate that their income has been hit because of the pandemic.

“For the purpose of restructuring, the bank will depend entirely on the customer’s assessment of when they expect their income to be normalised or to get employed,” said SBI managing director C S Setty said while announcing the scheme.

The country’s largest lender has been the first to roll out a protocol for restructuring loans of retail borrowers who were affected by Covid-19. Other lenders including HDFC and ICICI Bank are expected to follow suit before the end of the month.

To facilitate borrowers to understand their eligibility for restructuring, SBI has launched an online portal to enable borrowers check their eligibility for all retail loans. This includes home, education, auto, and other personal loans.

The restructuring will give breathing space for a borrower until their income is normalised or they get re-employed. Also, they will not be classified as defaulters or non-performing assets. The downside is that the bank will charge 35 basis points extra as interest since the RBI needs them to set aside additional provisions for these loans. This means that despite initial relief over the tenure of the loan, the borrower will end up paying more than on a regular loan without

“We have put in place a scheme for restructuring and it is available to borrowers through our internal portal. We have also intimated borrowers but don’t expect much of traction for restructuring given the inquiries,” said Rajkiran Rai, MD & CEO, Union Bank of India.

HDFC Bank has put in place a facility to submit online applications. The bank has said that it will report the loan to the credit bureau as ‘restructured’ and as per norms, all loans availed will be classified as restructured even if only one loan is being restructured.

“The dues for the moratorium period can be capitalised. Or else it will be very strenuous for the borrower to repay. Capitalising the dues will reduce the pressure on the borrower and we are also working on this by elongating the term of the loan,” said Siddhartha Mohanty, MD & CEO, LIC Housing Finance. He added that even if the loan term is extended, typically home loan borrowers end up pre-paying their loans by seven to ten years.

Borrowers who access SBI’s portal for restructuring will still have to visit the branch as a ‘wet signature’ is required for the loan document to be reworked. The portal will however take care of all the queries of the borrower. “It is not an end-to-end process but it will reduce the need for customers to visit branches especially during this time of Covid,” said Setty.

Government of India Launches online Real Estate Platforms, taking cues from its Staggering Potential

The outbreak of the pandemic has really turned the world economy down to a great extent. The most serious shatter it has done to the Real Estate Industry. Then flourishing industry had to face a lot due to this outbreak and trying its level best to stay stagnant. With development work at a total stop, ventures getting conceded, the previously feeble real estate has been severely affected by the COVID-19 pandemic. The industry presently is being helped by the government so that it could rise and shine again.

Some innovations envisioned would impact the future and have happened without any forethought. For example, from when a physical property visit was essential to lease or purchase a property where new companies are seeing various clients settling properties for lease, by means of video stroll through. This practice is one in foreign countries but this is the first time India is going to experience this Revolution. Many companies in India have launched their virtual tours so that they do not lag behind in the competition.

This virtual tour is turning out to be great as the investors who are willing to invest their capital are not facing any barrier. The extremely realistic feel is experienced via this 3D walkthrough. To investors, it is a convenient and a time saving opportunity. Maintaining the social distance, the deals are being done. The Indian Government is also contributing for the appraisal of the Real Estate Industry. The Government of India propelled two online land stages CREDAI Awaas App and NAREDCO’s online portals housingforall.com, to advertise private properties carefully.

The CREDAI Awaas App is a computerized portal and India’s biggest online platform for project revelation for many investors around the globe. The stage additionally plans to assemble an association for clients with guaranteed developers of real estate whose RERA-registered properties will be shown on the application.

NAREDCO’s online portal housingforall.com, is an e-commerce lodging gateway where homebuyers over the world can investigate and buy ready to acquire Properties in India. The application plans to encourage straightforward home purchasing in India of RERA enrolled extends and get responsibility and effectiveness in the process of home-purchasing.

The Leaf

The Luxury Address of New Gurugram.

Above All Else.

✅ Pay Only 20% on Booking, Possession in 2021

✅ Forest inspired landscape & ample green open space

✅ Luxurious club life

✅ 2, 3 & 4 BHK Luxury Homes

✅ Starting Price Rs. 1.09 Cr.*

✅ Located in Sector 85, Gurugram

40% properties for sale in The Leaf lies in range of ₹1Cr - ₹1.2Cr. 2 Bhk is the most common room configuration in this project and accounts for approximate 48% of all the properties on sale.There are 19 properties of 2 BHK available for sale in price range of ₹1.09 Cr- ₹1.18 Cr while 12 properties of 3 BHK available for sale in price of ₹1.61 Cr.

SS The Leaf Located in the sector 85 of Gurgaon, the leaf has been built in one of the most posh locations and is also in proximity to leading shopping malls and other recreational centers. Although it is not far from the main facilities, it is away from the chaos and pollution of the city. The location is thus absolutely perfect for a residential township or complex.

There are some unique facilities such as Flower Gardens,Indoor Squash & Badminton Courts,Meditation Area present in The Leaf compared to other projects present in Sector 85 .

DLF Limited presents a limited release of luxury independent floors for a discerning few who seek privacy and privileged living. A rare opportunity to own your own independent home, nestled in the heart of DLF City Phase 3, Gurugram.

Exclusive low-rise luxury floors

Presenting a limited release of luxury residences for a discerning few who seek privacy and privileged living. A rare opportunity to own your own independent home, nestled in an intimate enclave in the heart of DLF City, Phase - 3, Gurugram.

Independent floors in DLF City Phase 3 - heart of Gurugram, are accessible from both NH8 and MG Road with Moulsari Avenue metro station and DLF Cybercity in close proximity. Retail options with premier social destinations at DLF Cyber Hub and MG Road are only a short drive away.

The units are efficiently planned to carve out most usable areas. Each room is well lit and ventilated.

Covered car parking at the stilt level entrance with lift and staircase lobby and CCTV cameras provide a secure and comfortable experience.

|

|||||||||||

|

|||||||||||

|

|||||||||||

|

|||||||||||

|

|||||||||||

|

|||||||||||

|

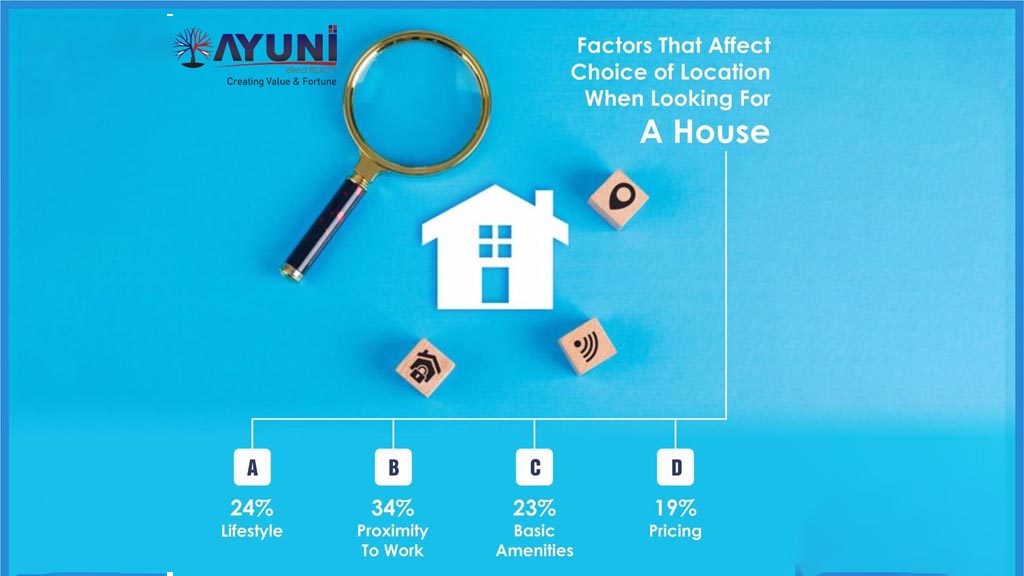

"Location, location, location" is a common mantra in real estate. And it's good advice—except for one thing: Most people have no idea what it really means.

A good location can signify different things to different people, of course, but there are also objective factors that determine a home's value. Depending on your personal needs and preferences, you may not be able to buy a home with all of these factors. And that's OK. After all, a home is much more than just an investment. However, the next time you're shopping for a new property, keep the following factors in mind.

Lohri is primarily celebrated in the Punjab region of the Indian subcontinent by Sikhs and Hindus. Each year, the festival is observed on the night before Makar Sankranti, in accordance with the solar part of the lunisolar Bikrami calendar.

Date:

This year, the mid-winter festival is being observed on January 13, 2021.

History and significance

There are several tales surrounding the origin of the Lohri festival. A few accounts attribute the origin of the festival to the Himalayan mountain region where the winters are colder than the rest of the country.

After weeks of harvesting the Rabi crop, people would gather around a bonfire and celebrate the passing of the winter solstice and the promise of the coming spring season. The festival is also dedicated to the sun deity, Surya, as on this day the devotees expect it's returning after the cold winter days and ask it for warmth and sunshine.

Another legend attributes the celebration of Lohri to the tale of ‘Dulla Bhatti’ who was a local hero of the Punjab region and during the reign of Akbar, worked as a saviour of the people. He famously saved a group of young girls from being sold into slavery.

His deeds have been passed down as a legend and are deeply inculcated in the Punjabi folklore. On Lohri, ‘Dulla Bhatti’ is celebrated and various songs and dances are performed in his honour.

Every year, January 26 is celebrated in India to commemorate the day when our constitution came into effect back in 1950.

This day is observed with festivities that take place in the national capital, New Delhi, with a mammoth parade that is watched by everyone around the country on their television sets. It is a moment that is engrained in our childhood and even now, a lot of us don't want to miss this.

However, this year this day will witness muted celebrations due to COVID-19. The number of people attending the event has been shortened and it is being made sure that all safety precautions are taken care of.

While that is happening, many have questions about the day. Right from the chief guest this year to the how's and why's about the date. Not only that, people are always curious about its history.

Therefore, here are the answers of some common FAQs that are related to this very day.

Without further ado, here is a look at some of them.

Who is the Chief Guest at the Republic Day this year?

Every year, a distinguished personality from another country is cordially invited to attend the parade on Republic Day. However, due to COVID-19, there will be no such guest gracing everyone with their presence. In 2020, Brazilian President Jair Bolsonaro was invited.

Why is Republic Day celebrated on January 26?

It is a very well known fact that our country had attained independence on August 15, 1947. However, the constitution was brought a year later. On August 29 of the same year, a drafting committee was formed to deliberate over what this will entail. The Constituent Assembly had adopted the constitution on November 26, 1949, and it was on January 26 in 1950, when the country was declared the Sovereign Republic.

Interestingly, on this day back in 1929, the Indian National Congress had also passed the Declaration of Indian Independence from the British rule, also known as 'Purna Swaraj.' Therefore, January 26 was chosen for these reasons.

Maintenance issues continue to plague many high-rise societies. Poor building construction quality and faulty fittings are across many such societies in India. Buyers need to perform pre-possession due diligence before buying.

A high-rise society offers a bundle of amenities within its premises to residents. Be it security, lifts, uninterrupted water and electricity supply or other facilities such as a park or a gym to give a sense of comfort to residents.

For residents to continue enjoying these services, maintenance plays a vital role. Without efficient maintenance, it becomes difficult to sustain services for which one buys a house in a housing complex.

Across India, maintenance agencies are hired to take care of the upkeep of a housing society. A facility manager oversees and ensures that everything is working fine and services are not hampered.

However, the quality of maintenance often remains a key issue of dispute between the builder and buyers. In case a society fails to upkeep the maintenance what exactly can residents do?

Joseph Reddi, senior vice president (Operations), Knight Frank India, suggests, “Pre-possession inspection is very important. First time the developer checks it and then when it is ready for handover everything related to construction related defects, fire fittings and other installations need to be checked. Snags like small holes or cracks are bound to be there, but fundamentals related to construction quality cannot be ignored”.

“If the construction quality is not good or there is a design defect then even the facility management can’t do much. Because of that, there are tussles between the agency and residents. So, buyers should do due diligence before possession,” explained Reddi.

Completion Certificate and Occupancy Certificate are two important approvals that a society has to take before possession is offered to residents. However, residents of several housing societies complain of faults in the fire equipment, lifts, common area facilities and other issues.

Abhilash Pillai, partner, Cyril Amarchand Mangaldas says, “Regulators are supposed to inspect the buildings and ensure it is fit for occupation before giving a completion or occupancy certificate. These certificates have a disclaimer that under law we do not have any liability towards this building. Hence, even regulators are not enforcing this properly. Consumers are forced to take possession as and when they are offered.

The RERA legislation talks about five years structural defect warranty but this still needs to be tested and evolved by the courts. Buyers should inspect the building before taking possession and ask the builder to correct any defect they find. Those who have taken defected possession can go to consumer courts and seek redressal of their issues”.

A south-India based company conducts home inspection during the buying process and prepares a report for buyers before the house is occupied or possession is accepted.

Sudhindra Naib, CEO, HomeInspeKtor, explains, “We prepare a 360-degree inspection report of the house and check flooring, blemishes, electrical and plumbing fittings etc. To determine the house quality, we have thermal cameras to check the moisture within the wall which cannot be seen with naked eyes. The house inspection report contains photos, issues and a to-do list which a buyer can take to the developer and ask him to fix it. Several developers in Bengaluru have welcomed this report and are ready to rectify the defects after seeing the report.”

A faulty inspection by regulators at the time of giving approvals lead to bigger problems at later stages. A faulty construction creates problems for residents who ultimately end up in legal forums to get these addressed. This is a common problem across many cities in the country. Buyers’ awareness is vital to inspect a building they are going to inhabit and get the same inspected before accepting possession. One can do it themselves or if possible, hire an expert to check the quality of the building.

NEW DELHI: The Delhi Development Authority (DDA) has received as many as 9,714 applications and payments from 2,955 applicants until Friday for Housing Scheme - 2021 offering 1,350 flats, a senior official told IANS.

The official said that a total of 49,416 applicants have registered under the scheme.

"The response to the scheme is great. We have received almost double the number of applications in each category of flats. This response is an indication that all the flats being offered will be sold," official said.

Under its new housing scheme, the DDA is offering flats in Dwarka, Jasola, Manglapuri, Rohini and Vasant Kunj.

As per the information, a total of 254 HIG (Higher Income Group) are on offer out of which majority are located in Jasola.

Pocket 9B flats in HIG category are available in the price range of Rs 1.97 crore to Rs 2.14 crore while 13 flats are on sale in Vasant Kunj in the price range of Rs 1.43 crore to Rs 1.72 crore.

As many as 352 MIG (Middle Income Group) flats located in Dwarka Sector 19-B, 348 in Dwarka Sector 16, and four in Vasant Kunj are on sale under the scheme while as many as 276 EWS flats in Dwarka's Manglapuri area are being offered.

"Of the 2,955 applicants who have paid up the booking amount, 659 have paid the amount for the EWS category, 444 for the LIG category and 1,852 for the MIG and HIG category. Most flats are likely to be completed by March 31, 2021, except flats in Dwarka, Sector 16B which are likely to be completed by September 30, 2021," official added.

NEW DELHI: The dynamics of the real estate sector and its stakeholders witnessed a significant impact due to the covid-19 pandemic; however, the industry experts expects that the upcoming Union Budget 2021 would pave the way for opportunity and recovery. Both the developers and buyers hope that the Budget 2021 will introduce reforms like tax sops and correction in prices which will further benefit and stabilise the industry. Following are the various measure industry expects:

Circle rates

For the real estate sector the 20% deviation from the circle rates announced by the finance minister last year until June 2021 for homes costing upto Rs 2 crore, should not be time bound and needs to be extended for all real estate asset classes. The same will allow developers to offload the massive build-up of unsold inventory costing more than Rs 2 crore, says Kaushal Agarwal, chairman, Guardians Real Estate Advisory

Stamp duty for land purchase in affordable housing should be reduced or removed for next few years to promote the launch of such homes" says Pradeep Aggarwal, founder & chairman, Signature Global Group.

GST

The industry has been requesting for a GST removal on under construction homes to bring it on parity with ready homes which have no GST levy, says Amit Goyal, CEO, India Sotheby’s International Realty. Ashok Mohanani, president, NAREDCO Maharashtra on the other hand look forward to re-introduction of GST with input tax credit on under-construction properties which will generate the demand among homebuyers.

The government may accede to industry’s demand of allowing set off of GST paid on input materials during the construction phase against rent and other income from property upon completion. The lack of input credit is currently seen as a dual tax levy on asset owning commercial real estate developers that rely on leasing or rentals," adds Vivek Chandy, joint managing partner, J Sagar Associates.

Since the implementation of GST on transfer of development rights (TDR) is being interpreted for application of GST on transfer of right to develop the land. Due to this amendments, most of the projects either residential or commercial has reduced significantly. During this budget if there is a relaxation on GST for joint development transaction on T.D.R, it will be a huge benchmark for developers to take up projects for development," says Bijay Agarwal, MD, Salarpuria Sattva.

Income tax

"On the aspect of housing demand, Section 80 C tax deduction on home loan principal repayment does not provide for a focused benefit on housing. A separate annual deduction of INR 150,000 will provide the much-needed fillip to opt for house purchase," says Shishir Baijal, chairman and MD, Knight Frank India. To boost demand and provide relief to home buyers, we expect tax rebates for them such as a revision of the cap of Rs. 2 lakhs to a substantially higher number on housing loans under section 24(b) of the Income Tax Act. This would result in increased savings and provide a boost in clearing premium stocks. There is also a need for revising the affordable housing cap of Rs. 45 lakhs to a higher number considering the prices of land and construction in metro cities, says Ravindra Pai, MD, Century Real Estate.

Rent

The period of exemption from levy of tax on notional rent, on unsold inventories, needs to be extended to 3-5 years from two after receiving the occupation certificate.

CLSS

"To support the home buyers, we expect the Government to extend Credit Linked Subsidy Scheme (CLSS) of PMAY for middle income group, as well. The sector also demands to extend both, 100 percent tax deduction under section 80 IBA and the additional tax deduction of up to Rs 1.5 lakh for interest payments on housing loans taken for the affordable housing scheme, at least by a year till the market stabilizes," says Murali Malayappan, chairman and MD, Shriram Properties.

"The deadline for the credit linked subsidy scheme (CLSS) should be extended by two years up to 31st March 2023. Additionally, given the relatively higher house prices in major cities, the upfront amount of the CLSS subsidy should be increased to INR 3.5 lakhs (from the current level of Rs 2.3-2.67 lakhs depending on the income category) with corresponding enhancement in income criteria which shall make the subsidy amount more significant in comparison to the house value," says Baijal.

REIT

The budget should also promote greater uptake of new efficiency measures, such as the use of contract saving schemes or Real Estate Investment Trusts (REITs), which will increase the viability of housing schemes across the nation and unlock new investment opportunities, says Nimish Gupta, managing director (South Asia), RICS. For REIT, the government should reduce the timelines of investment from three years to one year for long-term capital gains taxation; thereby ensuring larger retail investor participation and easing a long-term funding challenge for such projects," says Baijal.

Stress fund

The government may also make provisions for direct infusion of funds in the sector through existing channels like SWAMIH funds. Also another fund as SWAMIH funds-II should be launched which should be state centric and where in state institutions can contribute 50% of capital. This should have the regional offices in respective states to fund only to projects in Tier 2 & 3 cities which are untouched till date, under current fund," says Pradeep Misra, CMD, REPL.

We urge the government to offer a special package with a mid to long term horizon for the real estate sector to recover and embark on a sustainable growth path. This package should consider not only affordable and mid segment housing, but also other asset classes such as commercial offices, SEZs, IT parks, industrial parks, warehousing & logistics parks, and organised retail developments, amongst others because the sector is an ecosystem that thrives on cohesivity. Sankey Prasad, chairman & MD at Colliers International India

Affordable housing